The Lawmatics Blog

Insights on legal marketing, automating the law practice, and legal tech in general

Lawmatics, the leading CRM for law firms, today announced it has been named to G2’s 2026 Best Software Awards, placing #11 on the Best Legal Software list. G2, the world’s largest and most trusted software marketplace, reaches over 100 million buyers annually. Its annual Best Software Awards celebrate the world’s best software companies and products based on verified user reviews and market presence.

This ranking reflects a year of Lawmatics accelerating the shift to automated, AI-driven law firm operations, most recently with the full launch of QualifyAI, an AI agent that instantly identifies a firm’s best-fit leads based on firm-defined criteria and historical analysis. Lawmatics has also expanded its ecosystem with deeper practice management connections, including a new partnership with Filevine and a recently released integration with LEAP. Together, connections like these form a full suite of integrations that support firms within the systems they already rely on, from reception to practice management, helping reduce manual handoffs and streamline workflows.

“Law firms are being asked to move faster and deliver a better client experience with lean teams,” said Matt Spiegel, co-founder and CEO of Lawmatics. “Our mission is to unleash law firms’ full potential by putting trustworthy AI agents to work across intake and marketing. That means the right inquiries are identified early, the next step happens automatically, and teams spend less time on manual follow-up and more time doing high-value work. Implementing automation and AI as core infrastructure removes so much of the chaos and inconsistency that holds law firms back. Being recognized by G2 reinforces that our customers are gaining a competitive advantage from our approach.”

“As buyers increasingly shift to AI-driven research to discover software solutions, being recommended in the ‘answer moment’ must be earned with credible proof,” said Godard Abel, co-founder and CEO at G2. “Our Best Software Awards are grounded in trusted data from authentic customer reviews. They not only give buyers an objective, reliable guide to the products that help teams do their best work, but they’re also the proof AI search platforms rely on when sourcing answers. Congratulations to this year’s winners, including Lawmatics. Earning a spot on these lists signals real customer impact.”

Lawmatics was also recently awarded a Bronze Stevie© Award for Customer Service Department of the Year in the Computer Software - Up to 100 Employees category.

As an estate planning attorney, you understand that precision and attention to detail are paramount. You strive to provide exceptional service to your clients, but manual processes can create inefficiencies and challenges that can negatively impact your productivity, profitability, and client satisfaction. Automation is no longer just a buzzword in the legal industry; it is a necessary tool for law firms to remain competitive and thrive in today's market.In this article, we will explore the benefits of implementing automation solutions in estate planning law firm practices. We will discuss the four administrative processes that all estate planning lawyers should automate, and the impact automation can have on your practice's efficiency, accuracy, and client experience.

Why it’s time to start automating at your firm

While it may be tempting to resist change and stick with the status quo, the reality is that relying on manual processes can lead to several inefficiencies and challenges. Missed deadlines, higher error rates, and inconsistent service delivery can impact your practice's reputation and bottom line. Clients expect efficient, streamlined processes in today's fast-paced business environment. Failure to meet these expectations can lead to a negative reputation for the practice, ultimately causing you to lose clients to competitors who have embraced automation.Automation solutions can help you and your team work more efficiently and effectively, enabling you to focus on high-value tasks like research, drafting, and client interactions. Automating repetitive tasks such as document creation, data entry, and appointment scheduling can save time and resources, reduce errors, and increase profitability. Additionally, automation can help free up resources and employee time that can be allocated to generate new business and increase revenue opportunities.Throughout this book, we will provide captivating stories, imaginative examples, and data-driven insights to support our main points. We will discuss intriguing and counterintuitive ideas that challenge the status quo and help you think about your law firm's operations and processes in new ways.Whether you're just starting to explore the possibilities of automation or ready to take your estate planning practice to the next level, this book will provide you with the guidance and knowledge you need to succeed. So, let's get started and explore the benefits of implementing automation in estate planning law firm practices.

How to start setting up Automation

Automation can transform your law firm's processes, making them more streamlined, accurate, and time-efficient. But implementing automation can be overwhelming, especially if you need help figuring out where to start. Here's a short guide for setting up automation at your law firm.

Step 1: Discover your blueprint

Discovering your blueprint is the first step toward automating your law firm's processes. You and your team should identify the processes that can be automated. This step is critical because it sets the foundation for everything that follows. By understanding how automation can transform your law firm's current processes, you can plan for automated workflows to make your team more productive. You can confidently move forward and decide which automation solutions are right for you.You need to understand how automation can help you achieve your goals and improve efficiency. This step is about feeling empowered to take control of your law firm's processes and ensuring that they work for you, not against you.

Step 2: Design your vision

After discovering your blueprint, it's time to select the right automation processes or solution that fits your unique needs and aligns with your law firm's vision. With so many options available, it can be overwhelming to choose the right one. Create a shortlist of potential automation solutions and compare the options to find the best fit for your law firm. Consider cost, ease of use, compatibility with your existing software, and customer support.Many case management systems and CRMs integrate with tools like email, calendar, or document management systems. Remember when shopping for new software or solutions, everything in your tech stack should be integrated, so you can automate workflows and reduce manual effort.

Step 3: Build your structure

Now that you know what processes you will automate and have your chosen solution ready, it's time to implement and integrate it into your law firm's existing software systems.For this step, create a project plan that outlines the implementation process, including the resources and timeframe needed and training materials for your team. Work with the team to ensure the automation solution is fully integrated and easy to use.Disruption to daily operations is a concern, so take every step to minimize it. By building your structure, you'll feel relieved that the automation solution is running smoothly, saving your team time and increasing efficiency. You'll have peace of mind knowing that you've made the right choice and that your law firm is on track for greater success.

Step 4: Refine your design

Implementing automation is not a one-time deal. It's iterative. Test and refine the automation process to make sure it's working for your team (not against your team). During this time, create space for feedback from team members, look at performance reports and analysis, and refine the process.

Step 5: Create your masterpiece

You need to monitor automation's impact on your law firm's operations, productivity, profitability, and client satisfaction. With ongoing data analytics reports on key metrics such as time saved, error rate reduction, and increase in revenue, you'll be able to see the positive impact that automation has had on your firm.

1 From friction to flow: automating your law firm's client intake process

You understand how important it is to provide personalized and efficient services to your clients. However, the client intake process can often become a major bottleneck, causing frustration for potential clients and your staff. Call answer rate tends to be lower than law firms realize, leaving potential clients primed to keep looking for other legal services. Consider implementing a call-tracking software to make sure your calls are being answered.

Using resources like chatbots, online forms, and- even- virtual receptionists, you can quickly answer frequently asked questions and schedule appointments without manual intervention. This reduces friction for potential new clients and saves your staff valuable time, allowing them additional bandwidth.It's important to note that automation doesn't mean replacing human interaction entirely. Instead, it's about using technology to augment and improve the client intake process. You can free up your staff to focus on building relationships with potential clients and providing more personalized and strategic services when you automate the more routine aspects of the process.

Friction for leads to contact you

Your website is often one of the first points of contact for potential clients. Chatbots are a very popular integration on law firm websites and social media channels as they provide quick and helpful answers to frequently asked questions, such as where you practice, what types of legal services your firm offers, or how to schedule an appointment. Chatbots can help potential clients get the information they need quickly and easily, reducing the likelihood that they'll bounce off your website and look elsewhere.

Online intake or contact forms effectively collect important information about potential client's legal needs and backgrounds. Potential new clients can fill out a form on your website, give your team critical information upfront, and reduce the time it takes to get to the heart of their legal needs. Online forms can also help you weed out leads who may not be a good fit for your firm, such as those with conflicts of interest or those who cannot afford your services.Reducing friction is critical to making it easy for potential clients to engage with your firm. We want to see an increase in sign-ups and filter out the bad leads after.

From lead to client: using automated screening questions to streamline your intake process

The goal for leads isn't quantity but quality. Only some leads will be a good fit for your law firm, and investing time and resources into a client who isn't the right fit can be draining for your team.Adding a series of questions to your online intake forms lets you quickly weed out potential clients who may not be a good fit for your firm.Focus on the following:

- Where are they located, and can your law firm assist them in that geography?

- Think about the client's financial situation. Will they be able to afford your services, or will they be unlikely to pay their bills?

- Ensure the client's needs align with your firm's practice areas.

With a good CRM, you can automate conflict checks. Automating the screening process saves you time and resources, ensuring you only invest in the most promising leads. You can avoid misunderstandings or miscommunications by setting clear expectations with potential clients from the outset.

Automate nurturing leads

As a law firm, you know how important it is to generate new leads. However, getting those leads to convert into clients can be a challenging task. Automated email campaigns can be an effective way to nurture leads and turn them into estate planning clients. You can build trust and establish your firm's expertise by sending automated emails that provide valuable information.Here is a campaign idea to get you started nurturing leads that aren’t quite ready for your services:

The "Estate Planning Checklist" campaign

Estate planning can be overwhelming for new clients. By creating an automated email campaign that provides a step-by-step checklist of various estate planning processes, you can help ease their worries and guide them through the process. This campaign can include emails that cover topics such as creating a will, selecting a guardian, and choosing a power of attorney. Social proof is a powerful motivator, so include client testimonials throughout this campaign. Show potential clients the positive experiences others have had with your firm.

2 Automate client communication

Automating your communication can help you streamline communication, reduce errors, and improve efficiency. However, some law firms may worry that automation will reduce the human touch and lead to a less personalized experience for their clients. But here's the thing: automation doesn't have to mean less human touch. It's about alleviating additional work for your client-facing staff.

Automate consultation scheduling

Use appointment scheduling software to automate the scheduling of client appointments based on your availability. It can also automatically send reminders and confirmations to you and the client, decreasing the chance of no-shows.

Increase proactive communication

You can set up automatic emails and text messages that integrate with your case management system Using tools like automated workflows in your CRM- keeping your clients informed and building trust and confidence in your services.Automated email templates and text messaging can also be customized to match your brand voice, ensuring your clients feel like they're receiving personalized communication from your firm.With a centralized system, you can access valuable information about each client's communication history, preferences, and feedback, which can be used to tailor your interactions with them. By providing more personalized and attentive service, you can set yourself apart from other law firms and establish a reputation as a trusted advisor.

Outsource help and hire a virtual receptionist

A virtual receptionist can help you automate client communication in various ways, including answering calls and directing them to the appropriate staff member, scheduling appointments, sending reminders, screening calls, and providing basic information to clients.

3 Benefits of automated workflows

As an estate planning lawyer, you are no stranger to the demands of a busy practice. Between managing clients, drafting documents, and navigating complex legal requirements, keeping up with everything on your plate can be challenging. This is where the concept of automated workflows comes in.Automated workflows are designed to help you streamline your processes and automate repetitive tasks, freeing up your time and energy to focus on high-value work. You can save time and boost productivity by automating routine tasks such as document assembly and filing, calendaring, scheduling meetings, setting follow-up reminders, and time tracking.

Efficiency

Efficiency is key to running a successful estate planning law firm, and workflows can boost your efficiency. Automating repetitive tasks and streamlining processes can free up your time and energy to focus on high-value work. This can help you accomplish more in less time, leading to increased productivity and a greater sense of accomplishment.For example, you can use the automated workflow engine to set up task reminders for specific tasks or deadlines, ensuring they are completed on time. You can also use it to automate task assignments, ensuring that tasks are assigned to the most appropriate team member based on their expertise or availability. This can help improve efficiency and productivity while ensuring that tasks are completed correctly.

Seamless collaboration

Collaboration is essential in any law firm, and the Automated Workflow Engine can help ensure that everyone is working towards a common goal. Using collaborative workflows, you can assign tasks to the right people at the right time, reduce confusion and misunderstandings, and easily share ideas and feedback with your colleagues.For example, you can use automation to assign tasks to specific team members, set up notifications for completed tasks, and track progress on a shared dashboard. This can help ensure everyone is on the same page and working towards a common goal.

Scalability for law firms

As your estate planning law firm grows, it can be a challenge to keep up with the demands of your expanding client base. This is where automation can help. By automating repetitive tasks and implementing scalable workflows, you can create a flexible system that grows with your business, allowing you to maintain high standards while increasing your capacity to take on new clients.For example, you can set up workflows that can be easily scaled up or down based on your business needs. You can also use it to automate client intake and onboarding processes, ensuring that new clients are seamlessly integrated into your system.

4 Automate invoicing and make it easier to get paid

To make invoicing less of a hassle, use software designed for invoicing, the invoicing process can be automated. Invoice templates can be created to reduce the time and effort required to create invoices from scratch. Setting up recurring invoices and integrating payment processing with invoicing software makes collecting payments and tracking outstanding invoices easy. Look for invoicing software also includes features that track the status of invoices, such as whether they have been paid or are overdue, so you can easily follow up with clients and ensure timely payments.Here are some steps your team can take to automate the invoicing process:

- Choose an invoicing software: Several invoicing software options are available to help law firms automate their invoicing process.

- Create templates: Your team can create invoice templates that can be used for different types of services, reducing the time and effort required to create invoices from scratch.

- Set up recurring invoices: For clients who require regular invoicing, your team can set up recurring invoices that are automatically generated and sent to the client on a specific schedule.

- Integrate payment processing: Many invoicing software options integrate with payment processing platforms, such as PayPal or Stripe, making collecting payments and tracking outstanding invoices easy.

- Use invoice tracking: Invoicing software often includes features to track the status of invoices, such as whether they have been paid or are overdue, which can help your team follow up with clients and ensure timely payments.

Get clients to pay on time

Law firms can automate payment reminders to clients via email or text message to encourage clients to pay on time. Try using a payment portal to make it easy for clients to pay online using payment options like credit cards, ACH, or PayPal.Automating the process of adding late payment fees to invoices not paid on time can incentivize clients to pay on time. For clients who may not be able to afford your services outright, offer flexible payment options, such as payment plans, payment methods, or different payment frequencies. Payment plans alleviate financial stress of your clients, you can be certain that your bills will be paid.

Start automating at your law firm

Automating administrative tasks can streamline your workflow and increase your firm's efficiency. With Lawmatics, you can capture new leads and collect relevant information from potential clients. You can also generate documents using pre-defined parameters such as geographic location and case agreement terms. Lawmatics provides a secure way to share documents with clients while also providing features such as automated reminders & notifications to ensure maximum efficiency throughout the entire process quickly & easily.One of the most popular features of Lawmatics is its billing solution. Lawmatics' billing software can help firms make timekeeping, invoicing, and client payment seamless. Whether your law firm bills hourly, fixed-fee, or on contingency, Lawmatics' time and billing software offers the easiest way to seamlessly record billable hours, meaning more revenue for your firm. Get a demo today.

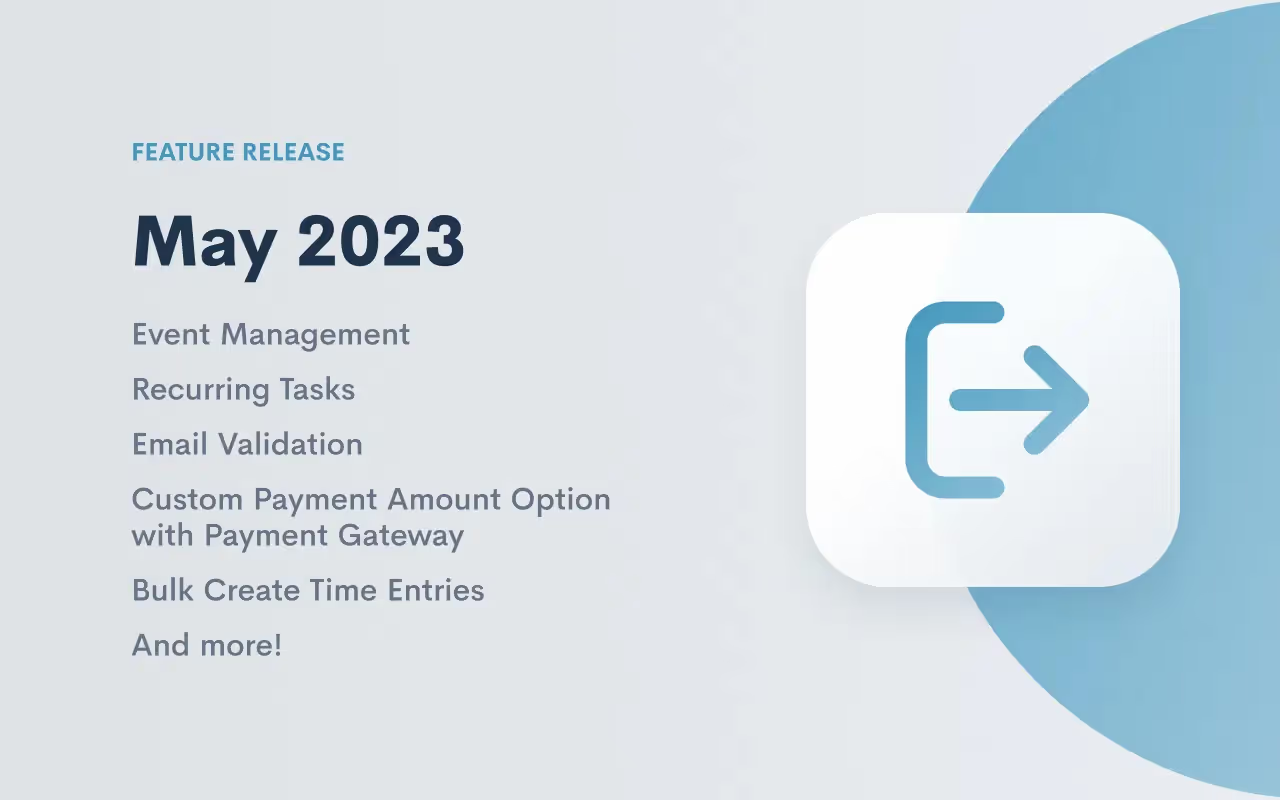

They say that April showers bring May flowers, and things have certainly been blossoming in the Lawmatics garden this May. From our team to yours, we are delighted to share this month’s crop of new features!

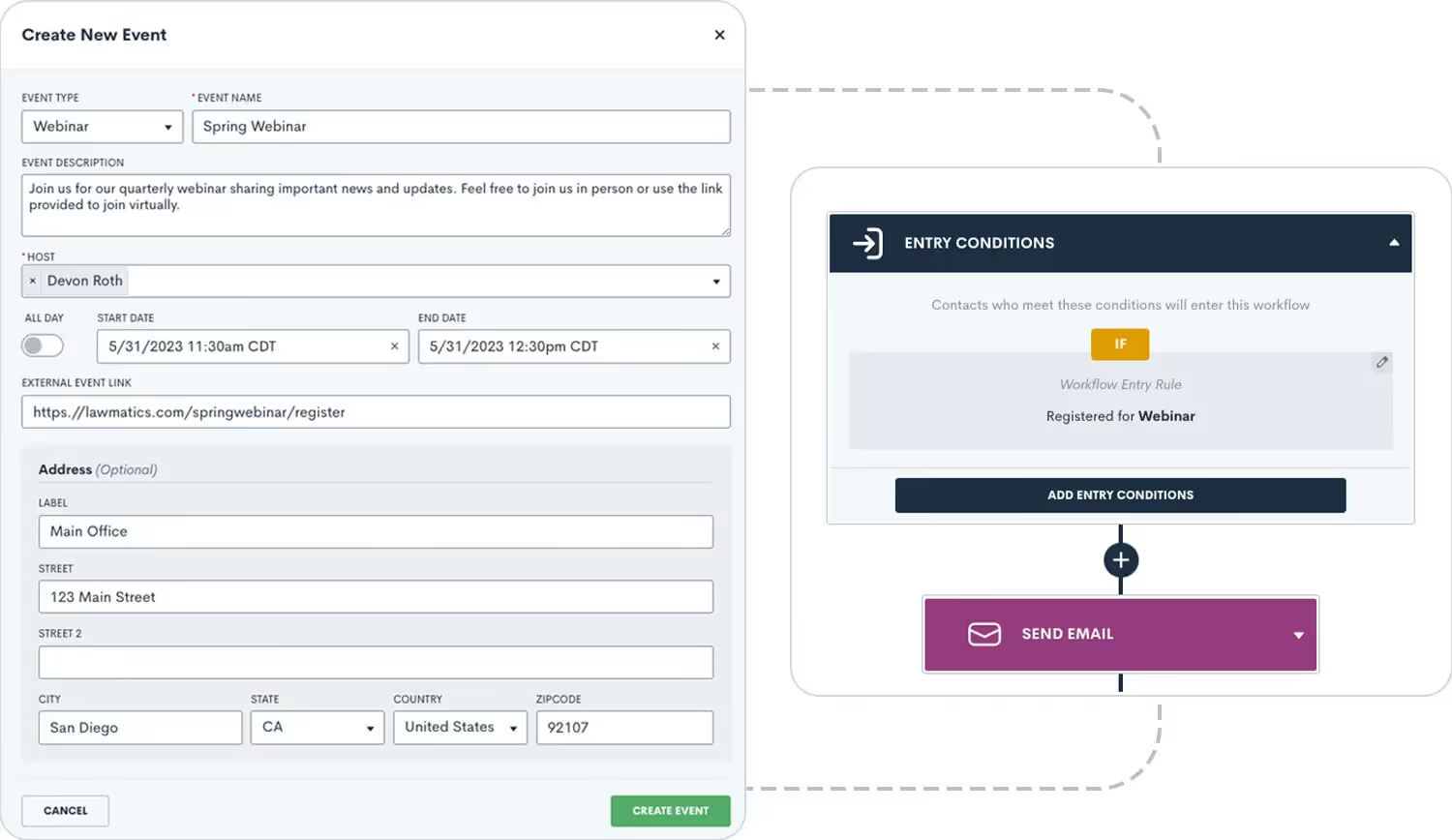

Event Management

Remember when we changed ‘Events’ to ‘Appointments’ within the platform? That’s because we were making room for this expansive new feature. So many customers told us they attract new business by hosting webinars, seminars, luncheons, and other events to engage potential clients. We heard you loud and clear – that’s why we’re so excited to announce that all of these events can now be managed in Lawmatics!With our brand new Event Management feature, users can set up different event types (webinars, luncheons, etc.), easily create and promote an event, and collect registrants. We’ve added a setting for built-in confirmation and reminder emails, and you’ll find a new entry condition to Automations to trigger a custom workflow when someone registers for your event. No matter how your firm brings people together, you can do it all in Lawmatics.Learn more about using this exciting new feature here.

Recurring Tasks

Stay on top of your to-dos like never before with our new Recurring Task capabilities! Create a task as you normally would – either by itself or within an Automation – then select a custom recurring schedule (monthly, weekly, every 3 days, etc.). When the first iteration of the Task is completed, the next Recurring Task will be created with the same Name, Description, Subtasks, Status, Priority, and Assignee. Just another way you can streamline your processes with Lawmatics.

Click here to read more about Lawmatics Tasks.

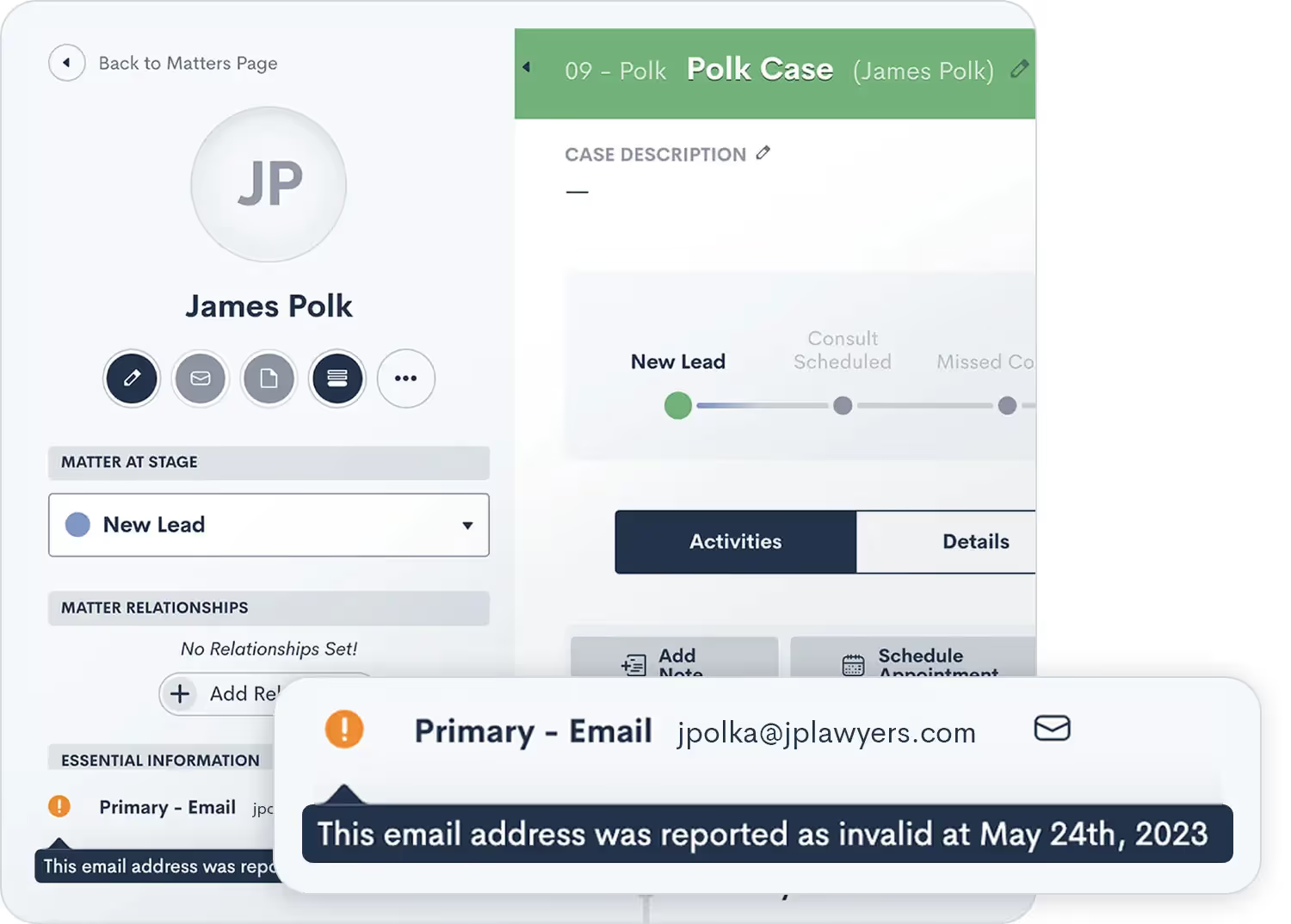

Email Validation

While Lawmatics makes it a breeze to automate your email communication, you can’t send out those emails without first having a valid address for the recipient. With our new email validation feature you will clearly see whether or not a contact’s email is valid before you even try to send them anything. This gives you the opportunity to correct any typos and ensure they don’t miss out on any important emails from your firm. Also included with this new feature: we have added an option for all email automation actions, allowing you to choose whether an invalid email address should fail the Automation or be skipped over. Just choose “Skip if Target has Invalid Email” when building the Automation if you do not wish for an invalid email to fail the Automation.Learn more about sending emails via Lawmatics here.

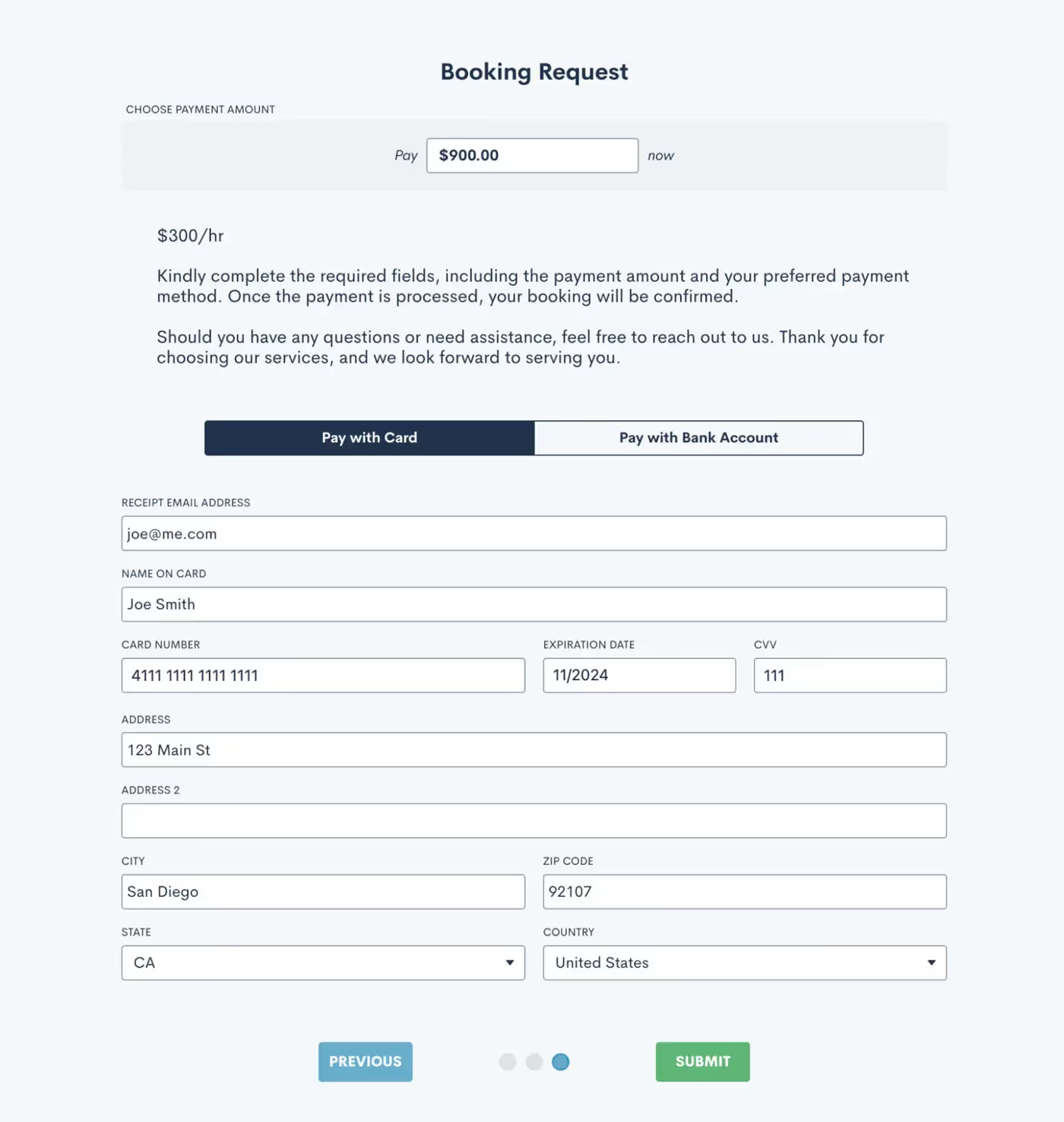

Custom payment amount option with Payment Gateway

LMPay has quickly become a fan-favorite feature, including the addition of the Payment Gateway that allows you to collect consultation fees directly from a booking form. We’ve added to this feature yet again by giving you the option to allow a client, or more commonly an internal user, to enter a custom payment amount when needed. This is useful for collecting payments that have a custom amount applied, such as a discount or add-on. Additionally, when using the form internally you also now have the option to reference a certain invoice number to apply a payment directly to a particular invoice.Not yet using LMPay? Click here to learn how to get started.

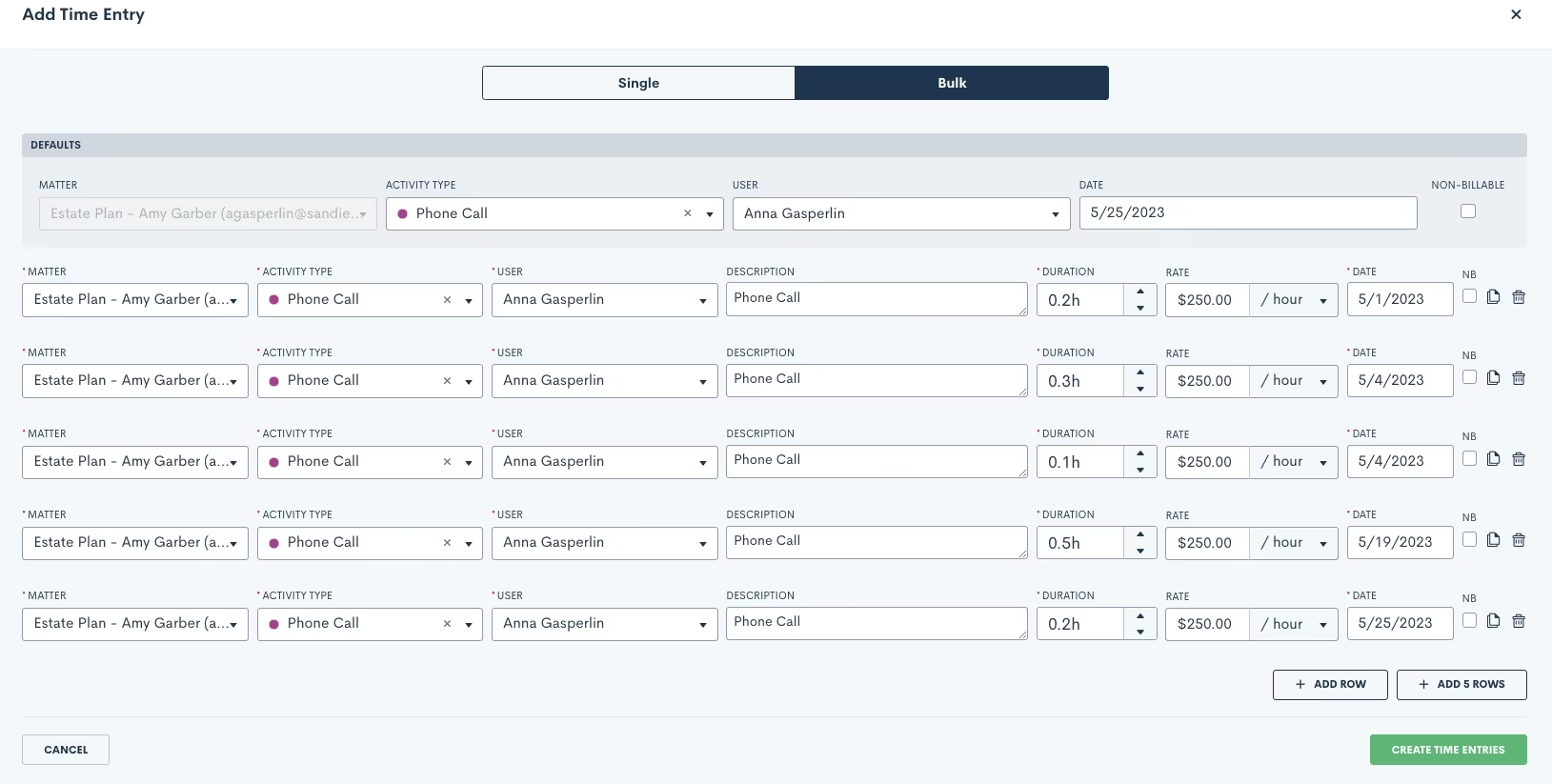

Bulk create time entries

For all of our Time & Billing users, you’ll love this new ability to create time entries in bulk for a particular Matter. Simply select the Matter, Activity Type, User, and Date to generate multiple time entries at once. Easily make different selections for any of those items on each entry, or keep them all uniform. This new feature makes it faster and easier to log multiple time entries.Read more about time tracking in Lawmatics here.

Also in this release:

- Control number of items shown per page

- Multi-select and bulk delete on Contacts page

- Continued user experience improvements and “Create From Within” additions

- Built-in reminder and confirmation emails now log on the Matter Activity Timeline

- Matter files automatically show in the associated Contact’s files as well

- Set a specific time on the Due Date for a Task

- Reports page now has a search bar to quickly find a report

- New notification option for failed LMPay invoice payments

As always, thanks for checking out this latest update from Lawmatics! Stay tuned for even more exciting features to come!

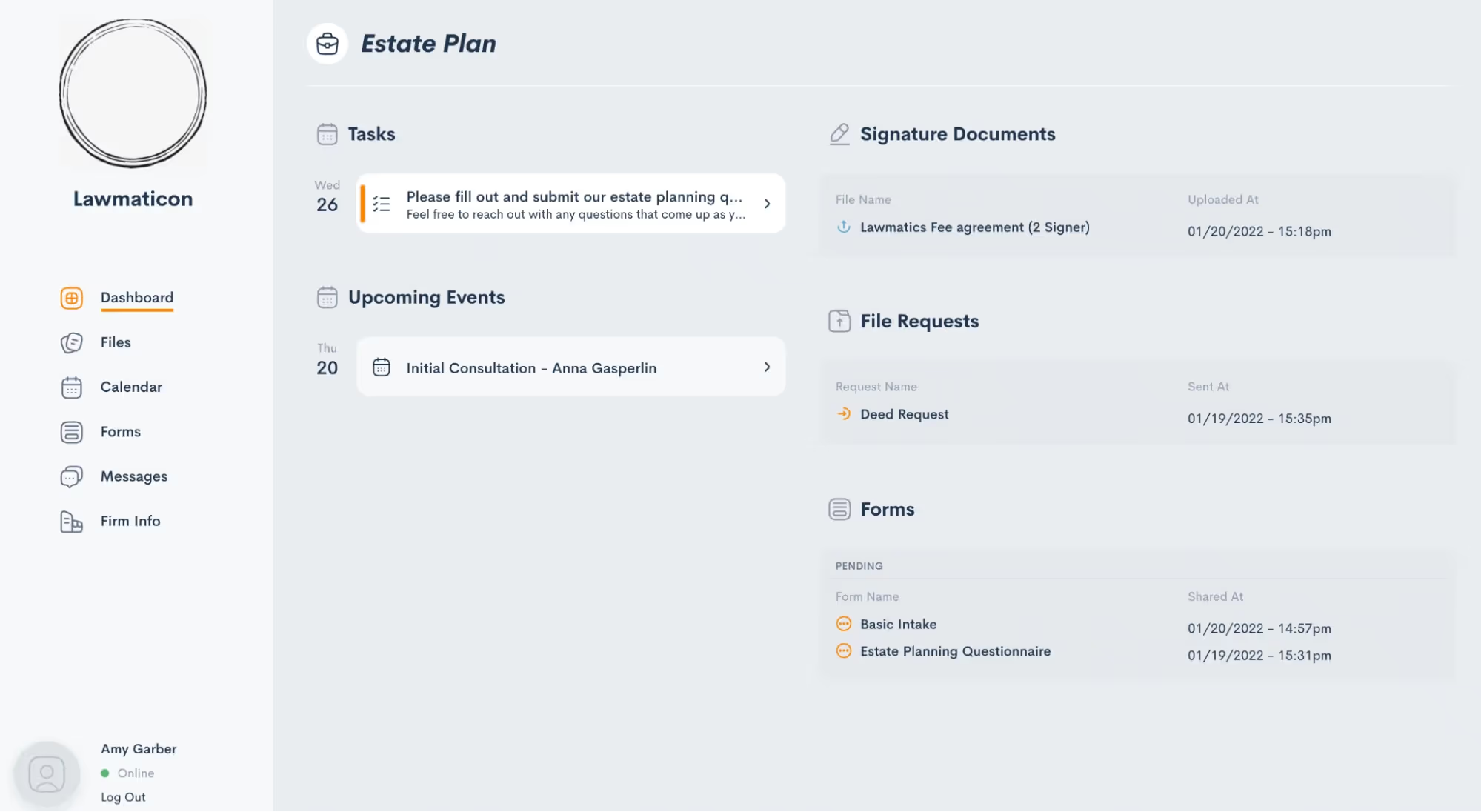

Register for upcoming Monthly Deep Dives here.The Lawmatics Client Portal has everything you need to both ease communication and manage action items for an ongoing case. Everything about the Client Portal is designed for easy activation, easy adoption, and ease of use for both your staff and clients.But why use the Client Portal when you already have Lawmatics automating so much of your client communication? While Lawmatics Automations are great for sending out important information such as Appointment Reminders, Forms, and Documents, the Client Portal allows your clients to access all of these items on their own terms, all in one central place.

The client’s view of their Client Portal, as shown above, is easy to navigate and contains each and every item relating to their case that you have opted to share with them. While we refer to this as the “Client” Portal, note that it can also be used at any point during your intake process as well.Let’s dive into all the steps of using the Client Portal to create stronger communication with your clients.

How to grant access to the Client Portal

Your contacts and clients have no means of entry to the Client Portal until they are granted access. This is done on a one-off basis so that you have complete control over who can access your shared information. Depending on the nature of your firm, you may see varying interest or necessity to access the Client Portal across your clientele.Like most things in Lawmatics, Client Portal access can be granted either manually or via an Automation. You also have the option to grant access to the primary contact on a matter and/or any other related contacts.

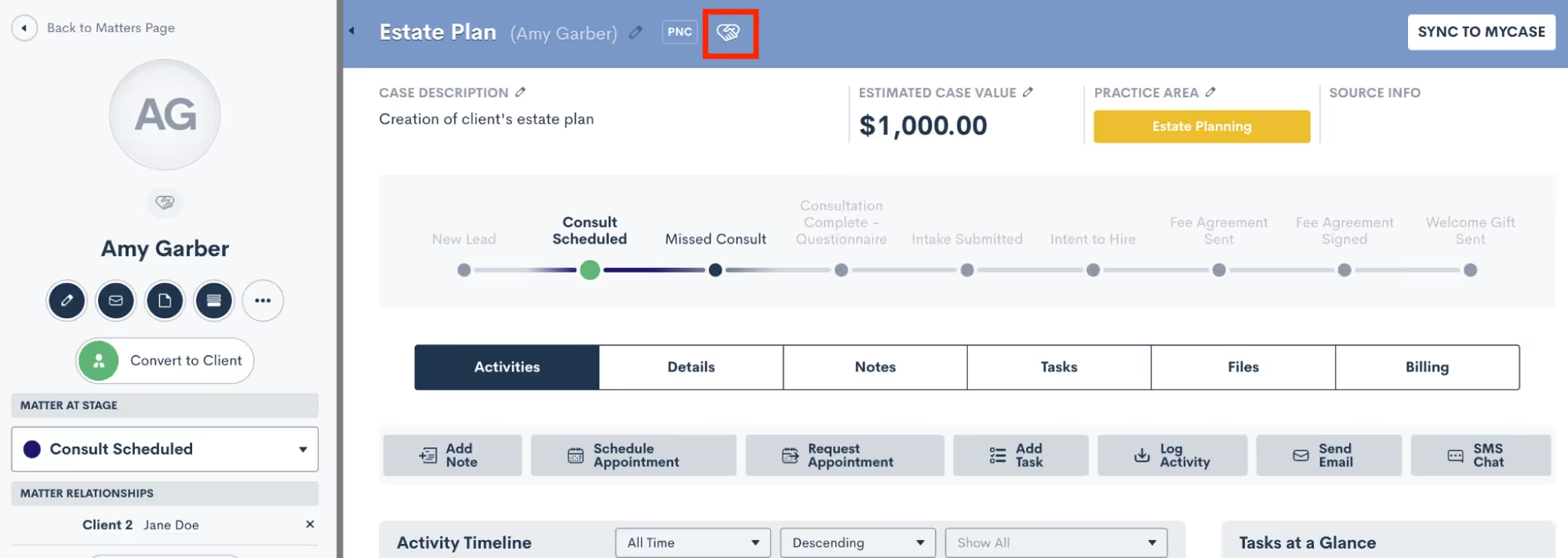

Send a manual invitation

To send a Client Portal invitation manually, begin by navigating to the matter’s profile. Again, remember that this process can be done for PNCs and hired clients alike. Once on the matter profile, click the handshake icon, highlighted in red (below).

You will then see options to grant access for the main contact on the matter, as well as any other related contacts. Check the box accordingly to grant access as you wish.

Each contact to whom you grant access will receive an email invitation to create a password and sign into their own unique Client Portal. For matters with more than one main point of contact, you can choose to share certain items with both/either of them as needed.You will only need to invite each contact to the Client Portal once, after which they’ll have ongoing access. The only exception to this are contacts who have more than one ongoing matter. The portal is unique to each matter, so you’ll need to send an invite for each respective matter.

Automate Client Portal access

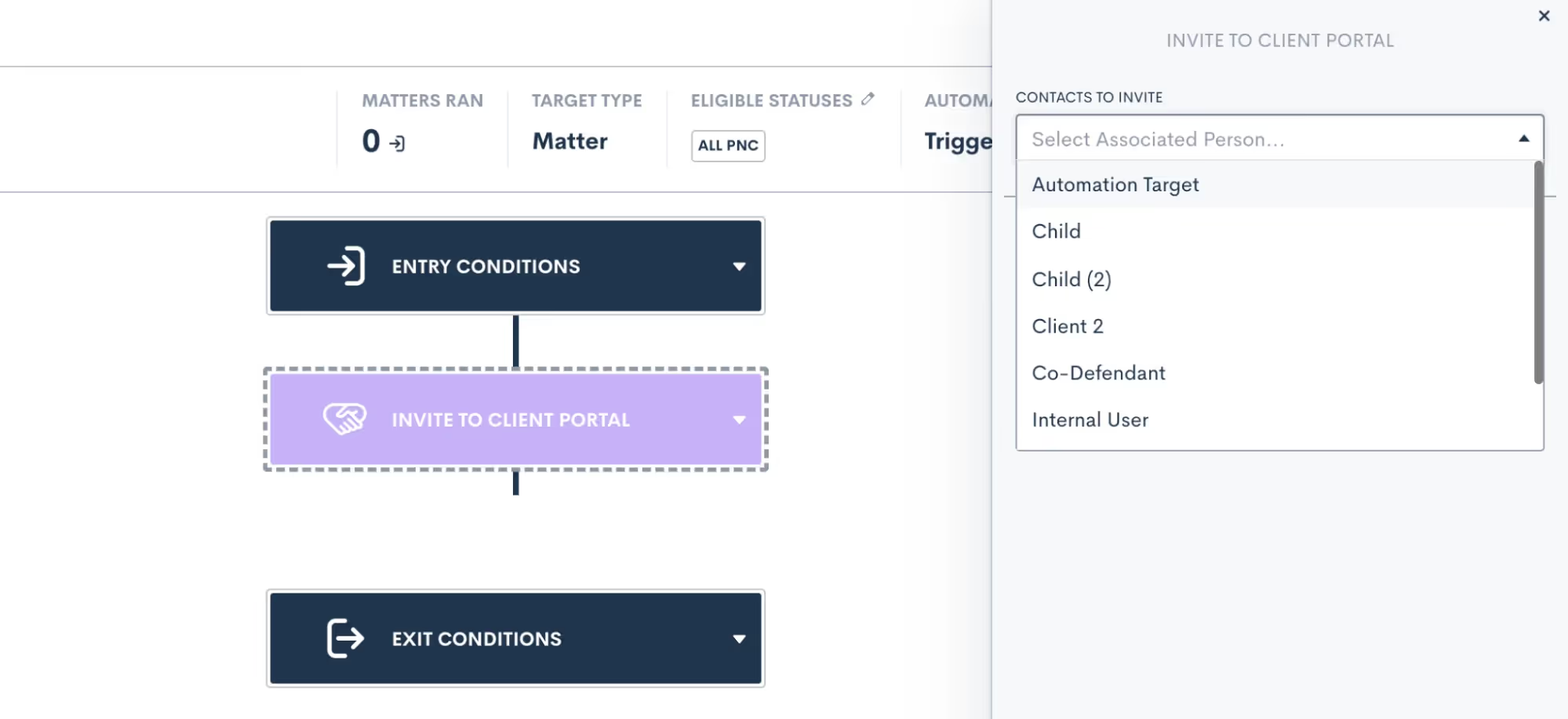

To automate Client Portal access, simply use the Automation action “Invite to Client Portal”, and then select which contact(s) to invite. If you only wish to invite the main contact on the matter then select the automation target.

You can also choose as many other relationship types as you wish. For any matters who do not have the relationship selected, no invitation will be sent to those relationships.Sending the Client Portal invitation via Automation achieves the same end goal as granting access manually. The contact receives an email invitation to create a password and get signed in to their unique Client Portal.Once the client has created their password, they can then use that to login to their portal any time they wish – by means of manual or automatic action,

Sharing items via Client Portal

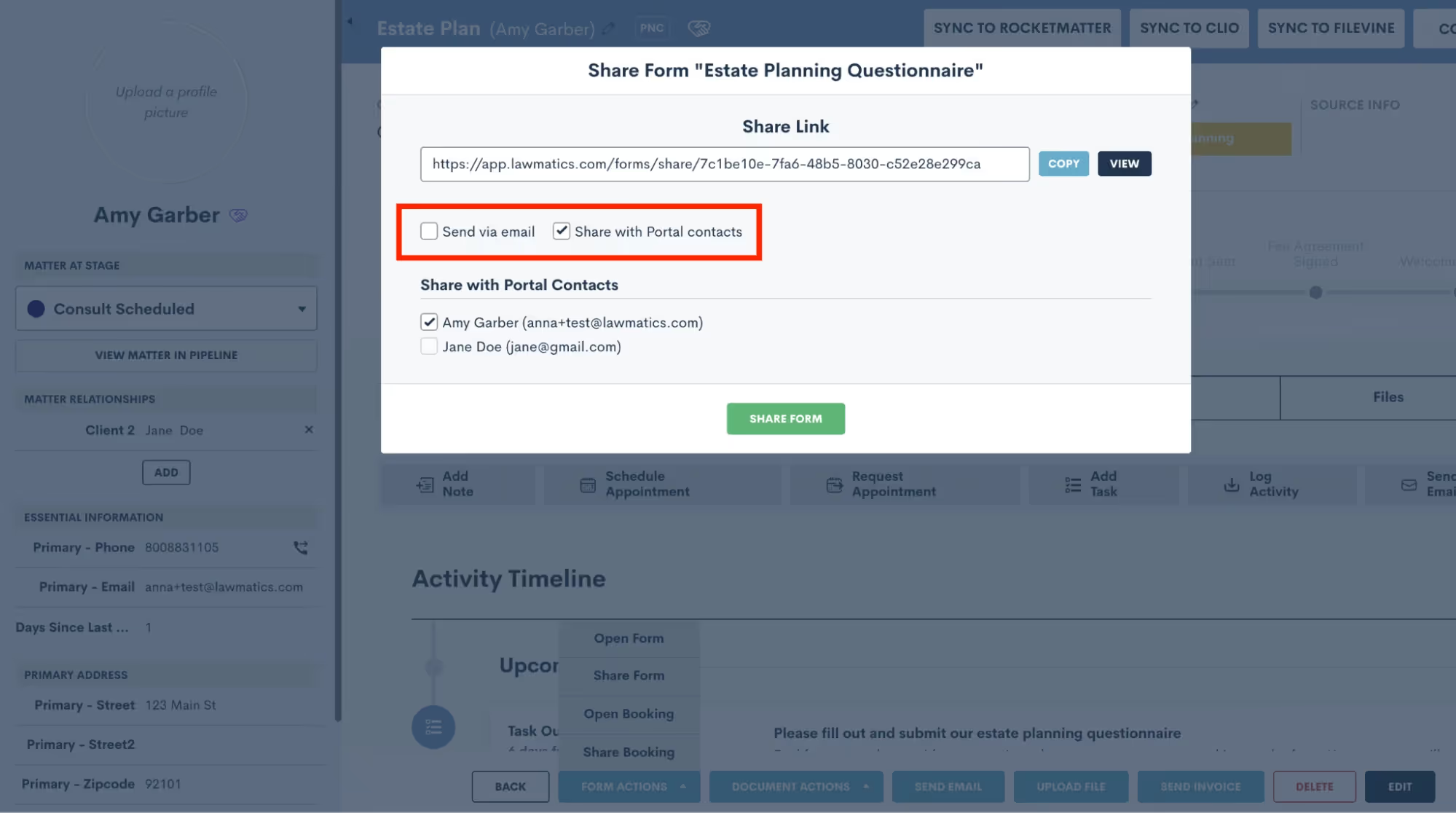

Now that your matter contact(s) have been granted portal access, you can begin sharing items with them. While you may still opt to share information such as forms or documents with a client via email or in-person, the Client Portal offers the added benefit of storing all such items in a central hub for the client to access on their own terms.As with a Client Portal invitation, you can choose to share any items to the Client Portal manually or via Automations. When sharing an item manually, simply follow your usual process for sharing via email, and you will see the option to share via portal as well.We’ll use Forms for our example here but this process is similar for any of your Lawmatics assets. When sharing a Form from a matter’s profile (shown below), you will see that you have the option to copy the share link, send via email, and/or share with portal contacts. Note that only contacts for that matter who have been granted access will appear in the checklist.

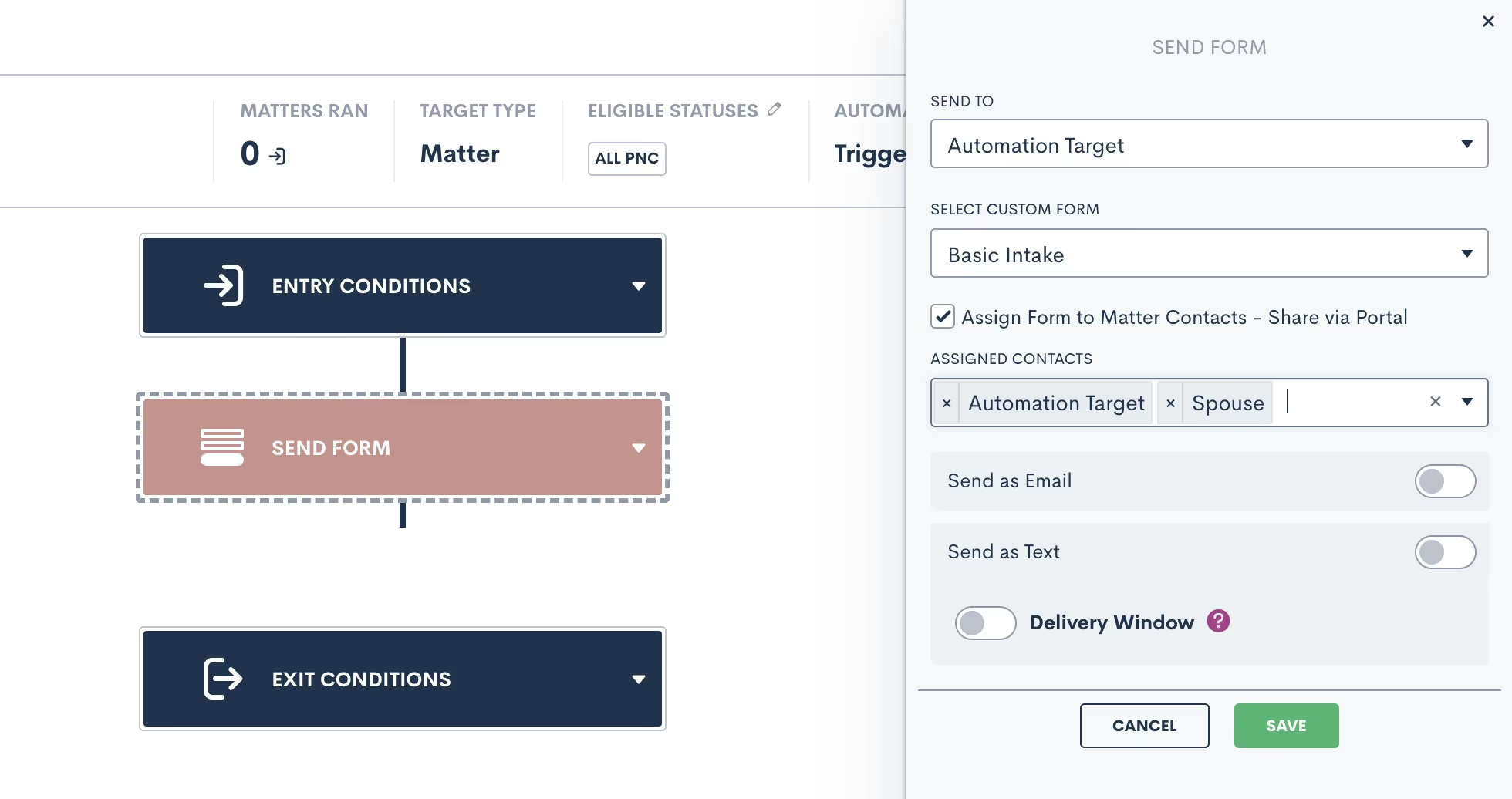

To share the Form to the Client Portal via Automation, simply use the Send Form action item in your Automation, and then make a similar selection to choose whether to share the Form via email, text, and/or to share via Client Portal.

When sharing any items via Automation, note that you will select the assigned contacts as part of the Automation template, as opposed to the one-off selection when sharing manually. Any relationship types selected will receive the shared item to their Client Portal; if a matter triggering through the Automation does not have one of the relationship types assigned, it will simply share the item with the applicable relationships and skip over any that do not apply.Let’s walk through each of the different items that can be shared via client portal.

Files

The first thing your client will see when they log in to their Client Portal is the Dashboard. Here they will find an overview of everything that has been shared to their Client Portal so far. They can then use the navigation on the left sidebar to view each individual item.Starting with Files, on this page your client can view any files that you have saved on their matter and upload files at your request.

Forms

Share Forms to allow your client to view and fill them out right in the Client Portal. You can of course share the Form via email as well, in which case the client can access it from the email or from within the Client Portal, whichever they prefer.

Signature Documents

Here, your clients can view any documents that you have shared with them for signature. Once again, you can send the document via email as well if you would like, and they can feel free to sign it from their email or from the Client Portal.Clients will also be able to view documents that have already been signed.

Appointments

The calendar tab allows your clients to easily keep track of their upcoming appointments. They will also see any Tasks that you have assigned to them, appearing on the date that they are due.

Tasks

You already love using Lawmatics for your internal staff Tasks, but the portal allows you to use this feature to assign tasks directly to a client. Create a Task the same way you would for an internal Task, whether manually or via Automation, and then check the option to assign the task to matter contacts, as shown below.

The Task will be visible in the Client Portal on the Dashboard, shown below, as well as on the calendar, shown on the task due date.

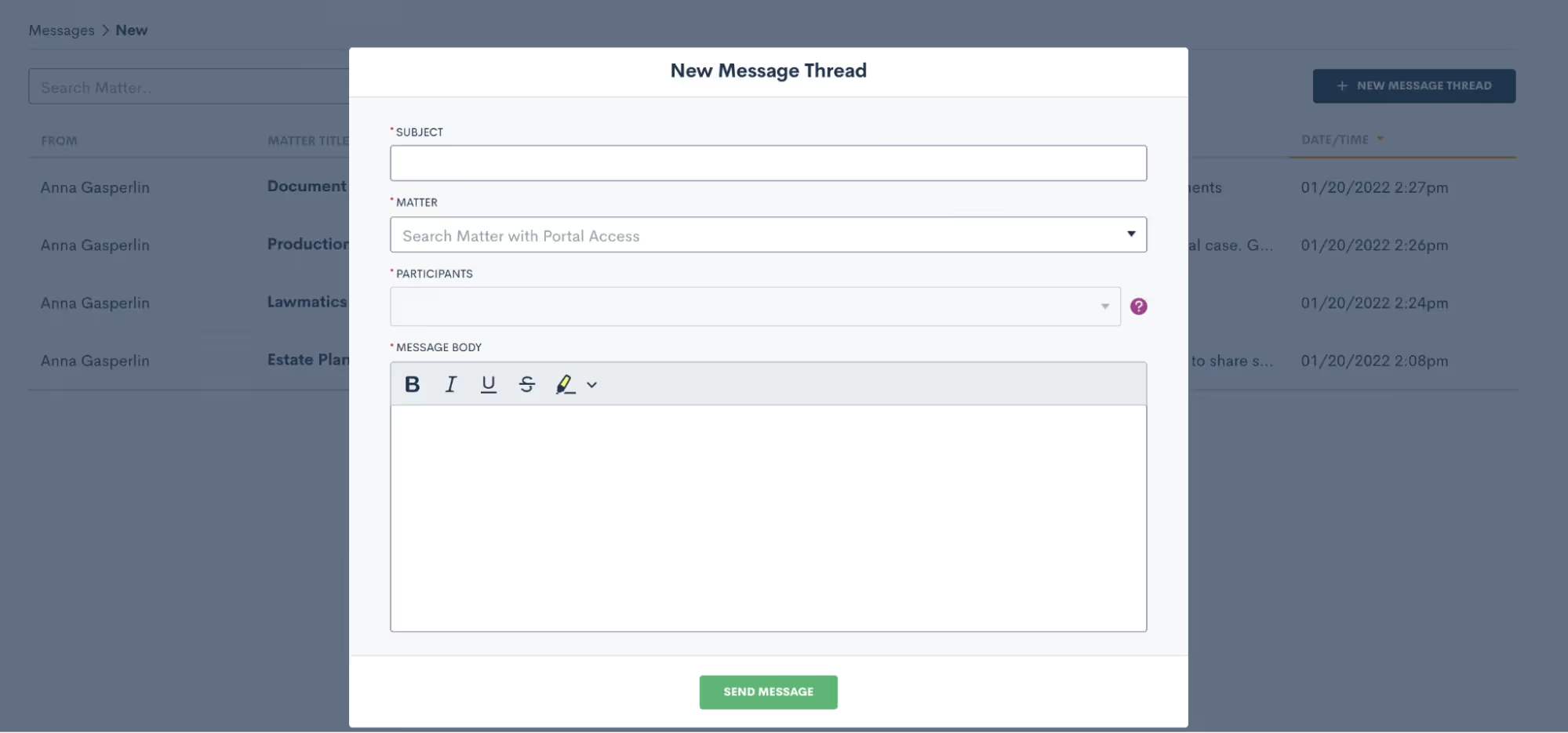

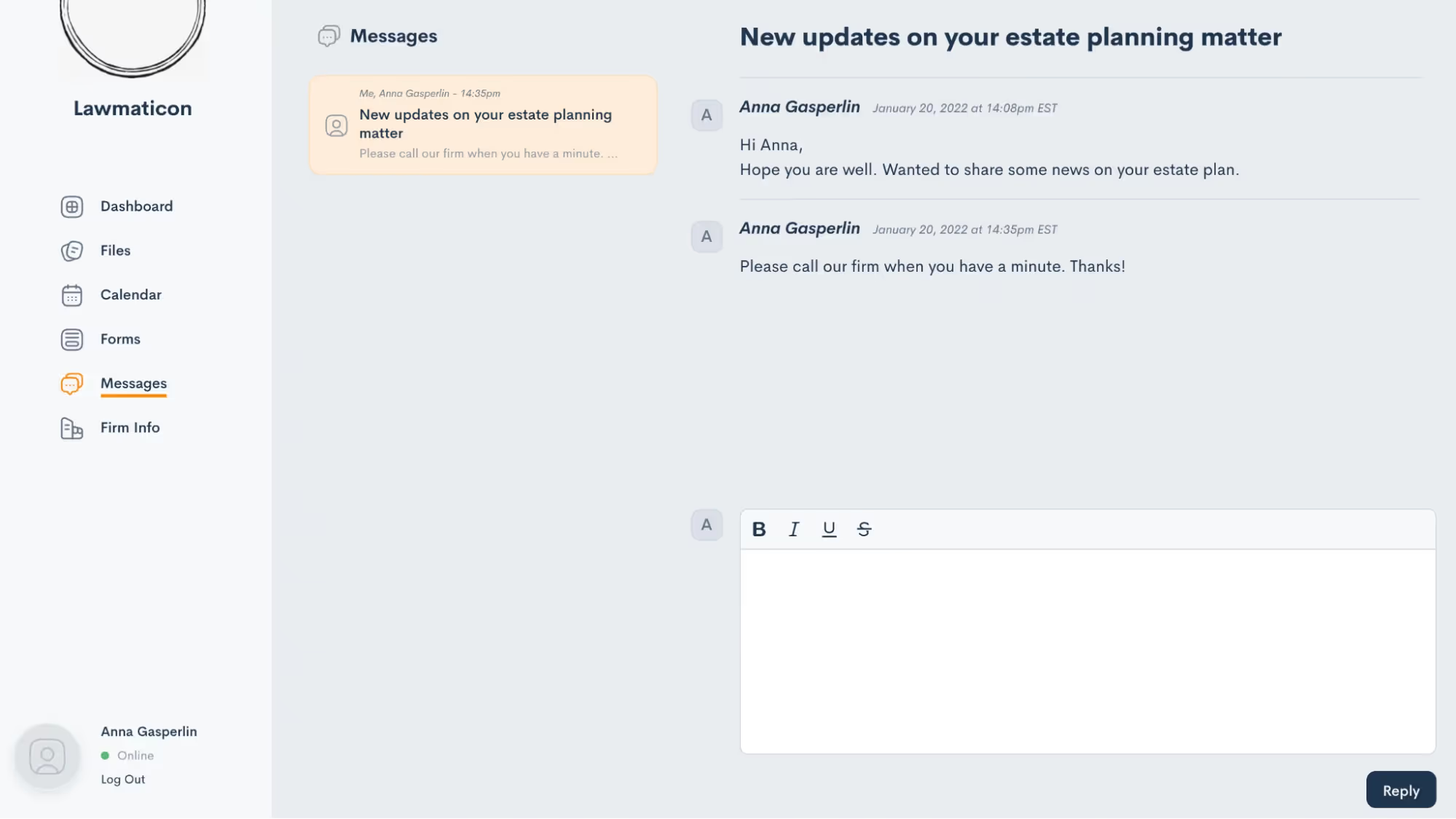

Messages

Last but not least, this feature is unique to the Client Portal and it allows you to message a client directly through their Client Portal. Sending a portal message is similar in concept to sending your client an email, however the benefit of sending via portal is that once again it helps keep all communication in one central hub.To draft a message, select Portal Messages from the CRM tab on your main Lawmatics navigation bar. You will then see a search box to easily search from any matters who you have granted Portal access to. Select the matter you wish to message, then draft the new thread as shown below.

Your client can then click on the messages tab within their Client Portal to view the full message thread as well as any past threads. The system will also alert them that they have an unread message. If a reply is needed, they can simply type their message in the box shown near the bottom of the image below, and reply right back to you.

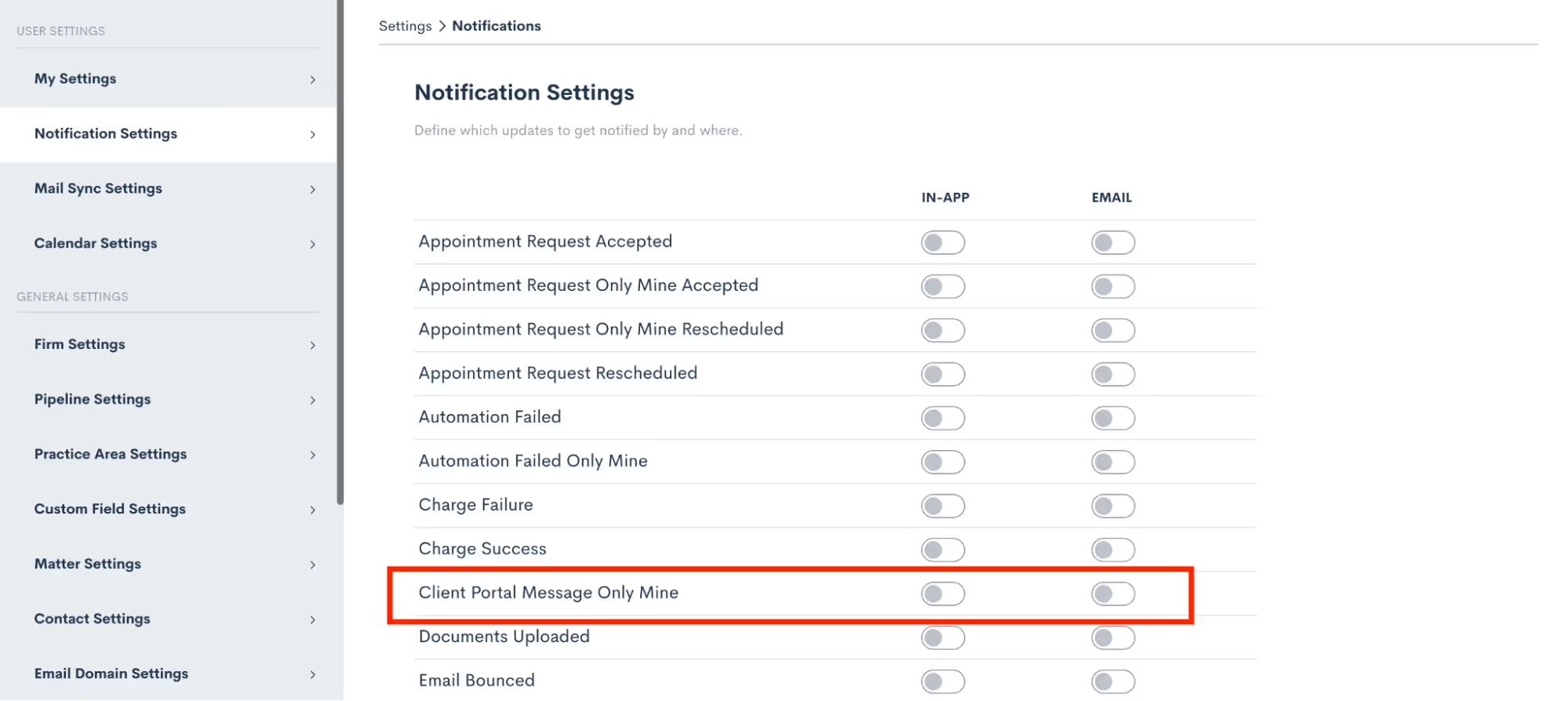

The reply will appear in your portal messages and you also have the option to turn on notifications for portal messages so that you can be sure not to miss anything.

Portal navigation

You now know everything you need to know about using the Portal and sharing items from Lawmatics to your clients. This whole process will function like a well-oiled machine once you have it implemented, requiring little to no intervention or checking in from your end.With that being said, you may still be curious what this all looks like from the client’s perspective. Let’s walk through each step from the client’s view and dive deeper into what they will see for each item.

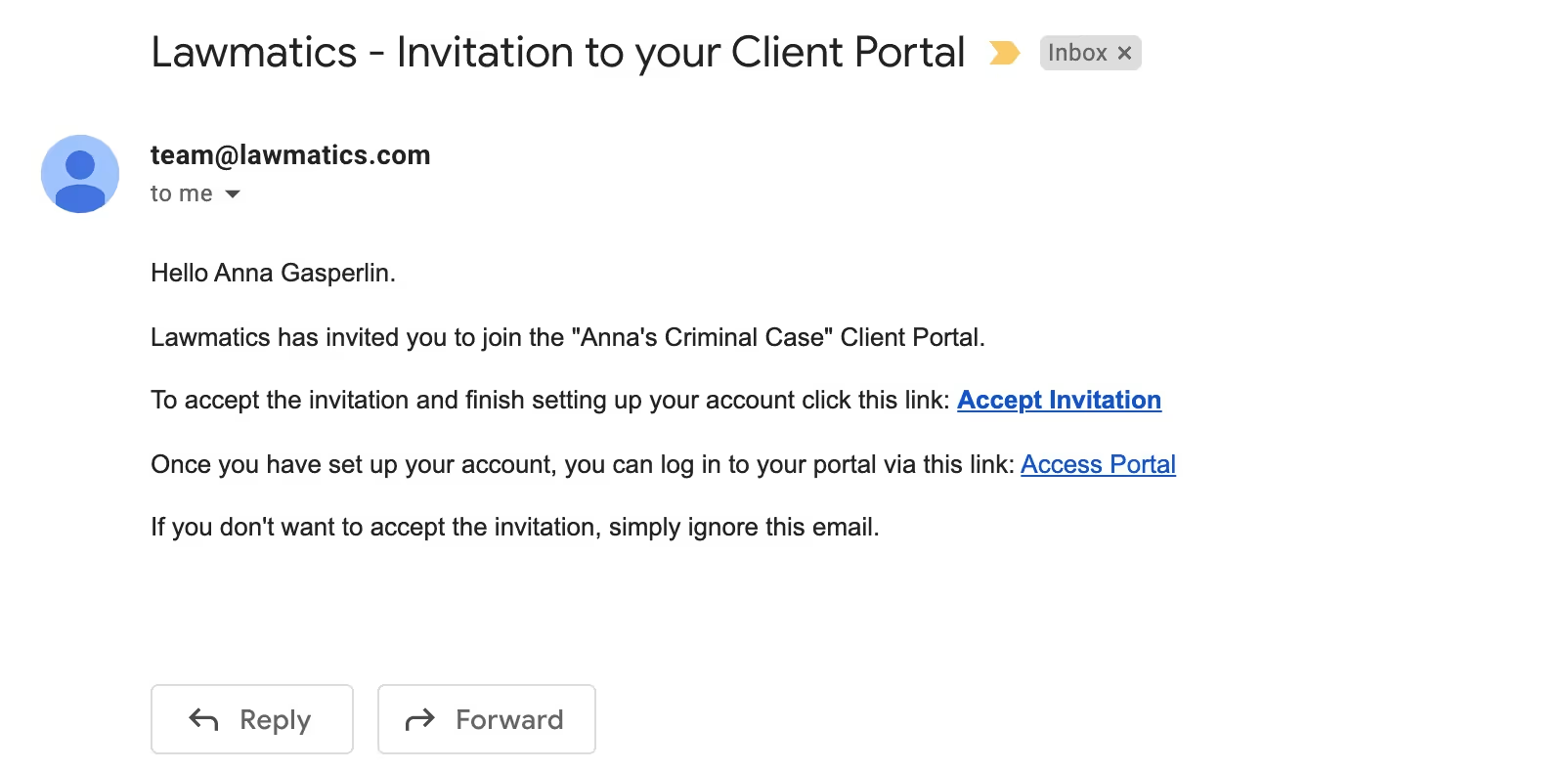

Invitation

First and foremost, when you grant Client Portal access to someone they will receive an email just like the one shown below. Note that wherever it says “Lawmatics” in this email will be replaced with your firm name. Additionally, the individual matter’s case title will be filled in where you see “Anna’s Criminal Case” below.

The Access Portal link doesn’t change, so you can suggest they bookmark that link or even save this email so that they can access the portal whenever they wish.

Portal

Whenever clients sign in to the Client Portal they will always first see their dashboard. This shows a summary of current events, messages, etc on their matter. They will then use the left side navigation to click through each different item.

Anytime you share an item with them, they will receive an email notification letting them know that they have something new in the Client Portal needing their attention.

Conclusion

The Lawmatics Client Portal is a simple, secure, and efficient way to keep your clients in the know throughout the whole course of their matter. Whether being used for intake or case management, the Client Portal is the client’s one stop shop to view everything for their case.With the ability to share invitations and items to the portal via automation, all of this can be accomplished without any extra work on your end. Not only is this a better experience for you and your staff, but this also creates a wonderful experience for your clients.Communication is such a key aspect of keeping your clients happy and engaged in their matter, with the help of the Lawmatics Client Portal it is now easier than ever to connect with your clients.

It has become increasingly difficult to find and keep top-level legal talent in a post-pandemic market. Firms of all sizes are having to rethink their entire recruitment and staff retention plans.In this webinar Lawmatics Director of Strategic Partnerships Blake Roberts welcomed Julia Taylor, CEO and Co-Founder of Hirics, a recruiting, staffing, and workforce solutions company. She’s also the Founder of LevLegal, LLC, a virtual paralegal and law firm consulting firm. They teamed up to cover the most effective strategies for law firm recruiting and team growth in today’s competitive landscape.

Time stamps of key takeaways

0:00 — Introductions

Learn a little bit about Blake and Julia. Then, get a high-level overview of the state of law firm staff recruitment and retention.

7:01 — How to find top talent on your own

Here, Julia outlines the groundwork you have to lay before you’re ready to recruit candidates. This includes honing your job description, preparing to talk about your company culture, and exploring recruitment channels that could readily yield candidates. She also takes a look at some common tech tools for finding talent, like Wizehire and social media.

12:07 — Best tools to retain talent

In a high-turnover industry, law firms have to pull out all the stops to keep top talent. Julia reviews all the retention levers available to firms, from staff culture to technology and achievement recognition.

17:45 — A holistic mindset

Recruitment and retention isn’t just about compensation. Along with financial wellness, employees consider factors like social, emotional, and physical health. Julia prepares you to think outside the box as you prepare your plan to entice future talent.

23:45 — Making a game plan

What recruitment work can you handle on your own? What aspects of it can you outsource? Julia walks through the resources available to distribute the workload in a recruitment search.

34:50 — Q&A

If you had a question come up during this webinar, someone else likely had the same thought. Stick around to see if anyone asked your question during the Q&A portion.

Webinar slide deck

Imagine a world where robots take care of the mundane day-to-day activities, like vacuuming or making dinner, just like in the old episodes of The Jetsons. While it may have seemed like a futuristic, infeasible fantasy at the time, the future is closer than we think.Although we may not yet have robots preparing our meals, we do have the next best thing: marketing automation. Despite being around for a while, marketing automation is rapidly gaining popularity, and for good reason. With digital marketing on the rise, automation is the ideal solution for businesses seeking to streamline their processes and improve their overall efficiency.By automating repetitive tasks that would otherwise take up valuable time, businesses, such as law firms, can focus their attention on more revenue-generating activities. But what are the most common uses of marketing automation? What are some marketing automation examples? More specifically, why do people need law firm marketing automation? Let's dive in.

Which industries use marketing automation?

Regardless of your industry, time is frequently cited as a luxury that one can never have enough of, so automated processes are the go-to to maximize your productivity. For this reason, automation software is more and more ubiquitous across the board, with some experts estimating that the automation software market will grow by an average of 9.8% per year over the next four years. Yet some industries rely on marketing automation more heavily than others— the legal industry being one of the top on the list.A recent legal trends report revealed that only 53% of lawyers are confident running the business side of their firm. This is understandable considering that lawyers went to school to learn how to practice law— not run a business. By harnessing the power of automation, busy lawyers looking to lighten up their load can delegate the marketing aspect of running a law firm to automation, and focus their efforts on what they were trained to do— practice law. Other top industries that rely on marketing automation include:

Online retailers

Online retailers have a substantial number of customers to keep track of and market to. Marketing automation helps them customize the customer experience and target new and existing customers with personalized recommendations.

B2B companies

With the help of marketing automation B2B companies can target decision-makers in their target demographic and nurture their leads via targeted communications. In addition, lead scoring plays a role in determining whether or not a lead is qualified, thus contributing to increased conversions. Besides lead scoring, other B2B marketing automation examples include:

- Email marketing automation

- Social media marketing automation

- Audience segmentation

- Retargeting

- Analytics and reporting

Healthcare

Healthcare organizations benefit from marketing automation by keeping patients up to date with the latest health education content as well as appointment reminders, encouraging patient engagement, and ultimately streamlining their communications.

Educational institutions

Educational institutions use marketing automation to automate the entire admissions process and also recruit students by sending out targeted communications to prospective leads.

Hotels

Hotels, resorts, and cruises use marketing automation to personalize and automate their guests' experience. From all pre-arrival communications, to following up post stay, marketing automation simplifies communication and keeps everything organized.

Financial institutions

Financial institutions make their lives easier by using marketing automation to market their services to specific groups of people based on their particular demographics such as income bracket, profession, or geographic location. With so many customers and leads to interact with, automation technology makes marketing simple.

What is an example of marketing automation in the Legal Industry?

With so many moving parts in a law firm, marketing often takes a back seat for busy lawyers knee deep in legal work. Yet marketing is an essential part of finding new clients. For this reason, implementing marketing automation can be a powerful solution for increasing your revenue without sacrificing time. Here are some marketing automation tools examples that can be used in the legal industry.

Personalized follow ups

Manually following up with everyone that calls your firm or fills out a client intake form is extremely time consuming. Automatic follow-ups with a personalized touch will engage your clients from day one, establishing trust and making them feel valued. You can personalize automated follow-ups by using merge fields into outgoing communications, which will insert the recipient's name into the email making them feel like you're talking directly to them. In other words each lead is taken from one stage to the next without you having to do a thing.

Onboarding

Most lawyers can agree that onboarding is easily one of the most tedious processes of running a law firm. Automation can help take the headache out of prospect qualification and onboarding by getting it done in a fraction of the time. Automated emails can welcome your new clients with a client intake form and provide them with all of the necessary information that they'll need about your law firm and what they can expect throughout the client journey.

Automated text messaging

Since not everyone’s form of communication is the same, automated text messages are a terrific way to market and send out important reminders. Texting allows you to communicate with your clients in a convenient and natural way. Marketing automation software like Lawmatics, allows you personalize your text messages for each contact thanks to merge fields, which avoids a “mass SMS” feel.

Appointment scheduling

Instead of losing time playing phone tag or email ping pong trying to find a time that works for both you and your client, automated appointment scheduling allows them to book their own appointments themselves. What's more, once they booked their appointment automated appointment reminders will go out significantly reducing your chance of no shows and saving everyone time.

Email campaigns

With marketing automation you can create a marketing campaign that delivers the right message to the right person exactly when it needs to go out. Features like drip email marketing send out emails that go out based on triggers of your choice whether someone first contacts your firm, or signs up for your newsletter. Audience segmentation software helps you create multiple campaigns that are individually targeted to different groups based on their different criteria such as case type, location or stage of the client journey. In other words, instead of sending out a general all-in-one marketing campaign, you can fine tune your marketing efforts that trigger unique groups of people therefore yielding better results.

What are marketing automation requirements?

Choosing the right marketing automation tool for your law firm won't just help you automate the repetitive day-to-day tasks that it takes to keep things going, but it can also improve your overall productivity and marketing effectiveness. However, not all marketing automation tools are created equal. You want to make sure that the right marketing automation tool you choose doesn't just have the right features, but also integrates easily other software programs in your tech stack. Some of the most popular marketing automation platforms include:

Hubspot

HubSpot is one of the more popular marketing automation companies with plenty of tools available to run inbound marketing campaigns and streamline your routine marketing tasks.

Marketo

Marketo is one of the fastest growing marketing automation platforms worldwide. It is geared towards B2B companies with the intention of engaging and moving leads through the sales funnel to help them grow.

Pardot

Pardot is a popular choice amongst B2B companies for automating common day-to-day tasks like digital marketing campaigns and tracking customer behavior.

Salesforce

Salesforce helps businesses build and manage email campaigns, craft social media personas, and offers automated text messaging to engage customers.

ActiveCampaign

Active campaign is consistently one of the most popular automated marketing software with customized and automated communications that go out exactly when they need to.

Lawmatics

As a lawyer, it helps to have an industry specific marketing automation software that integrates directly with other legal software you use in your law firm.For this reason, Lawmatics is the best all-in-one solution made for lawyers by lawyers. Law firms looking to automate their marketing and free up their time so they can focus on the growth of their business without having to juggle multiple softwares will love the simplicity that Lawmatics has to offer. Lawmatics integrates with softwares that you likely already use in your practice such as:

- Clio

- MyCase

- Zapier

- Rocket Matter

- Practice Panther

- LawPay

- Filevine

- CallRail

- RingCentral

- Smokeball

- Zoom

- Kenect

What’s more, Lawmatics offers an open API developer platform to build integrations yourself. Unlike some marketing automation softwares, Lawmatics is entirely customizable. You can set up your marketing messages to go out on whatever triggers you choose with easy step-by-step templates that are easy to understand.

Lawmatics core marketing automation features:

- Marketing Audience Segmentation

- Email Workflows

- Automated Text Messaging

- Drip Email Marketing

- Analytics

Lawmatics – the best all in one software made for lawyers by lawyers

Since Lawmatics is an all in one Legal client intake, law practice CRM, digital marketing automation, legal billing, document management, all in one easy-to-use law practice software, your clients will receive automated marketing messages based on where they are in the client journey without having to manually track where they are. Their contact information is stored in your CRM, making it easy to plug directly into your marketing communications. Not only can you easily connect with new clients, but re-engage with past clients. Are you ready to see how Lawmatics can help you take your marketing to the next level with the power of automation? Sign up for a free demo today!

When it comes to law firm marketing, I can’t think of a more competitive area of law than personal injury. To succeed in your area, you need to stay top-of-mind and differentiate from your competitors. For too long, many firms have relied on non-specific ads like TV commercials and billboards, but the rise of digital marketing has led to a necessary diversification of advertising methods.We need to start with a marketing strategy that focuses on trackable channels. Non-specific ads like TV commercials and billboards are no longer enough to stand out in today's digital world. By leveraging the power of digital marketing and tracking your efforts, you can be certain your marketing budget is well worth the investment.

Digital v. non-digital marketing

Traditional marketing methods like billboards and TV ads can effectively reach a broad audience and build brand awareness for law firms. However, it’s hard to track the success of these mediums.Digital marketing, on the other hand, allows law firms to target specific audiences and track engagement with their marketing campaigns using tools like search engines, social media, and online directories. Different digital marketing channels have their own benefits and drawbacks. Search Engine Optimization (SEO) helps law firms rank higher in search engine results pages but requires ongoing effort and resources. Pay-per-click (PPC) advertising can drive targeted traffic to a law firm's website but can be expensive and needs constant monitoring. Social media marketing can help build a law firm's brand and attract followers, but managing it can be time-consuming.So you need to carefully evaluate your budget, resources, and priorities to decide which digital marketing channels best fit your firm. By diversifying marketing methods, law firms can maximize their visibility and reach, build a strong brand, and engage effectively with clients across various channels.

Marketing metrics for law firms

According to the 2023 Marketing Outlook For Law Firms report from CallRail, only 42% of firms base their marketing spend on attribution metrics provided by reporting tools. Shockingly 65% of respondents don’t know what metrics to track and measure.Let’s fix that.Law firms, like any business, need to measure the effectiveness of their marketing campaigns to know that their marketing spend generates a positive return on investment (ROI). Here are some specific metrics and formulas that law firms should review:

1Return on Investment (ROI)

Starting off strong, ROI is a metric that measures the financial return of your law firm's marketing investments. In other words, it tells you how much money you're making in revenue for every dollar spent on marketing. A positive ROI indicates that a law firm's marketing efforts generate revenue that exceeds the cost of the marketing investments.ROI = (Revenue Generated from Marketing - Marketing Investment) / Marketing Investment x 100%

2Return on Ad Spend (ROAS)

ROAS measures the revenue generated from a specific advertising campaign relative to the cost of the campaign. So instead of generally looking at ROI, you can look at the ROAS of just Facebook advertising or just Local Service Ads.ROAS = (Revenue Generated from Ad Campaign / Cost of Ad Campaign) x 100%

3Marketing Expense Ratio (MER)

MER is a metric that measures the efficiency of a law firm's marketing investments by comparing its total marketing expenses to its total revenue. The MER is used both to calculate budgets and to benchmark spend.When used to benchmark spend, the MER compares a business's actual marketing expenses to its revenue. This allows you to evaluate the efficiency of your marketing investments and identify areas where you may need to adjust your strategy to improve your return on investment (ROI).MER = (Total Marketing Expenses / Total Revenue) x 100%When used to calculate budgets, the MER is used to determine how much a business can spend on marketing activities based on its total revenue and the desired MER. By setting a target MER, you know that you are investing a reasonable amount in marketing relative to your total revenue and can allocate their marketing budget accordingly.Say you want to achieve a MER of 12% (which would be an average percentage for PI Firms looking to grow their business). To calculate your marketing budget, you can use the following formula:Marketing Budget = (MER / 100%) x Total Revenue

So, if your firm has a total revenue of $3,000,000, your marketing budget would be:

Marketing Budget: (12% / 100%) x $3,000,000 = $360,000

This means that a reasonable starting marketing budget would be $360,000 for various marketing activities over the course of a year to achieve a MER of 12%.

4Cost per lead (CPL)

This metric measures the cost of acquiring a new lead for the law firm. It’s calculated by dividing the total cost of a marketing campaign by the number of leads generated. The lower CPL, the more cost-effective a campaign is.CPL = Total Cost / Number of Leads

So, your PI law firm runs a marketing campaign that costs $7,777 and generates 111 leads. To calculate the cost per lead (CPL), we can use the following formula:

CPL = $7,777 / 111CPL = $70

This means that the law firm is spending $70 to acquire each new lead.

5Customer Acquisition Cost (CAC)

CAC is a metric that measures the cost of acquiring a new client. By tracking CAC, law firms can identify the most cost-effective marketing channels for acquiring new clients and adjust their marketing strategies accordingly.CAC = Total Marketing and Sales Costs / Number of New Clients Acquired

From our example above, out of those 111 leads, 9 become paying clients. You already know that the law firm's average revenue per client is $17,777. To calculate the customer acquisition cost (CAC), we can use the following formula:

CAC = ($7,777 + total sales costs) / 9CAC = ($7,777 + ($17,777 x 9)) / 9CAC = $18,518

This means that the law firm is spending $18,518 to acquire each new paying client.

6Lead-to-Client Conversion Rate

This metric measures the percentage of leads that ultimately convert into paying clients. By tracking this metric, law firms can identify areas for improvement in their sales process and lead nurturing efforts.Lead-to-client conversion rate = ( the number of clients / the number of leads ) x 100%

From our example above, when we spent $7,777, we received 111 leads and 9 paying clients.

To calculate the lead-to-client conversion rate, we can use the following formula:Lead-to-client conversion rate = (9 / 111) x 100%Lead-to-client conversion rate = 8.1%

This means the law firm converts 8.1% of its leads into paying clients.

By using these three metrics together, you can gain insights into the effectiveness of your marketing campaigns and make data-driven decisions to improve your marketing efforts and intake process.

7Cost Per Case (CPCase)

CPCase is a metric that measures the cost of acquiring a new case for the law firm. It can be calculated by multiplying the firm's average case settlement value by a percentage representing the desired marketing spend per case. For example, if the firm wants to spend 20% of the average case settlement value on marketing, the CPCase would be 20%.CPCase = Average Case Settlement Value x Percentage of Average Case Settlement Value Spent on Marketing

Let's say your personal injury law firm has an average case settlement value of $50,000. You want to spend 15% of the settlement value on marketing to acquire new cases. To calculate their CPCase, we use the formula above.

CPCase = $50,000 x 15% = $7,500

So the CPCase for this law firm is $7,500. This means that, on average, you can spend up to $7,500 on marketing to acquire a new case and still generate a positive ROI.

Want to know more about marketing metrics? Check out 10 Best Marketing Metrics: How to Measure Your Law Firm's Marketing Success | Lawmatics

Essential marketing strategies for PI law firms

Clients are not just looking for logical solutions to their legal problems but also emotional connections with their legal representation. Personal injury attorneys who focus messaging solely on financial compensation risk missing out on building a robust and loyal client base.So while providing factual information and demonstrating your firm's experience is important, connecting with potential clients on an emotional level is equally important.With that in mind, you’ll want to look for ways to incorporate emotional calls to action, personal connections, and intimate stories into your messaging. You can establish a deeper connection with your potential new clients and increase the likelihood of converting leads into clients.

Connect with a personal injury website

With so many people turning to the internet to search for information or legal services, law firms need to have a strong website. Or…just have a website. According to the 2022 ABA TECHREPORT, 39% of solos and 12% of firms with 2-9 lawyers do not have a firm website.That is wild!And while I don’t like to make a habit of assuming, I will assume that 100% of you personal injury folks do have a website, given the stiff competition in your area of practice.So you already know that your website is the best place to showcase your brand, messaging, and testimonials. You’ll need a well-designed website that is easy to navigate and provides a positive user experience that can help establish that credibility, build trust, and encourage potential clients to take action.Providing easy-to-use navigation on your homepage can also help visitors quickly find the information they need and lead them to the desired action, such as scheduling a consultation.Want to know more about websites? Read 7 Essential Web Pages Your Law Firm Website NeedsUse language that speaks to your target audience. Keep your messaging clear, concise, and easy to understand, and avoid legal jargon or technical terms that may confuse visitors. Make sure to include a strong call-to-action that encourages visitors to take the next step in the conversion process, such as filling out a contact form or scheduling a consultation. Your call to action should be prominent, easy to find, and communicate the benefit of taking action.To build trust and credibility with visitors, include photos or videos of you and your staff. People want to connect; they don’t want to call into a large, impersonal call-center law firm. Have these photos on the homepage so potential clients can see who they will be working with.Take this one step further and include video testimonials of successful clients for social proof. Client testimonial videos build trust with potential clients by showcasing the people behind your law firm and the positive experiences of your past clients.While videos and photos of people are so important for branding and differentiating, you do need to keep your website fast-loading– especially on mobile. According to a recent study by Unbounce, nearly 70% of consumers admit that page speed influences their likeliness to buy. Users will exit your website and go to the next search result if they are frustrated. To ensure fast loading speed, consider working with a technical SEO expert.

Create interesting content

As Google continues to prioritize helpful, relevant content, personal injury law firms can benefit from creating informative blog content that showcases their expertise, provides value to clients, and improves SEO.Choose Relevant Topics: When creating content, focus on topics your potential clients find helpful. What questions do they call in about? What are you discussing during your initial conversations with clients? From there, create educational content or how-to guides. Provide educational resources, like step-by-step instructions for filing a claim, explain routine forms, or provide general advice about keeping medical records.Connect Emotionally: It's not just about the technical legal knowledge you share but how you present it to your readers. Emotionally resonating with your target audience will create a strong connection that can help foster trust and loyalty. Share stories of clients you've helped, including their challenges and how your firm helped them achieve a successful outcome.Use Engaging Formats: It’s not just about writing long blogs anymore. Make your content engaging by including images, videos, infographics, and other visual aids to break up the text and make your content more appealing.Optimize for SEO: Your content needs to be optimized for search engines. While keywords and on-page signals aren’t the whole piece of the SEO pie, they certainly will aid your efforts. Balance the content when it comes to keywords. While you should write about your local community, “keyword stuffing” can negatively impact your ranking.

Generate local business listings

One of the most important aspects of local SEO is generating local citations (in marketing, citations mean business listings). Citations are mentions of your law firm on other websites, such as local directories or review sites, including your business name, address, phone number (NAP), and website URL. Business listings help search engines identify your law firm as a legitimate business in the area, which can boost your local search rankings. As they say, the devil’s in the details, so make certain that your NAP is consistent across all citations, as this is a ranking factor.

Claim and optimize your Google Business profile

Google Business Profile (formerly Google My Business (GMB) is a free tool that allows businesses to manage their online presence across Google, including Google Search and Google Maps. Make sure that your profile is complete, accurate, and up-to-date, including your NAP, website URL, and business hours. You should also add photos and videos to showcase your law firm and services.Use this checklist to see how your Google Business Profile stacks up: How to Optimize a Google Business Profile for Law Firms

Develop link-building strategies

This marketing strategy is not for the faint of heart or– in this instance, a small law firm that doesn’t have a dedicated marketing team or agency. Link building is the process of returning links from other websites to your own. It is one of the bigger parts of the SEO pie, and backlinks can improve your local search rankings.Developing link-building strategies involves contacting other websites and asking them to link to your law firm's website. Still, it’s not quite as straightforward as it seems. There’s an exchange at play here, and you need to offer something of value to websites that will link to you. Some of the common link building practices in the legal field are:

- Sponsor local events or scholarships

- Participate in local business directories

- Write guest blog posts

- Create local resources or other original content

- Build relationships with podcasters or local media outlets

- Utilize broken link building

Referral marketing

Referral marketing is a powerful way to grow a law firm's business. Word-of-mouth recommendations from satisfied clients can bring in new clients who are more likely to trust and hire the firm. Here are the top 5 best ways to get more referrals for a law firm:

Say thanks and ask for referrals from satisfied clients

When you end a matter with a client, take the time to thank them for their business. We all know they could have gone to a competitor, but they went with you. A few weeks or months after their matter is settled, you can ask former clients if they know anyone else who could benefit from your services.

Be a joiner and networker

A great way to connect with other attorneys, legal professionals, or other business owners is to join the bar association or online communities or attend networking events related to your interests. Engage with these groups by answering questions, offering advice, and sharing your expertise. Build relationships with these people and ask for referrals when appropriate.

Show off your expertise

Are you your region's leading expert on left-turn trucking incidents? Well, now is your time to shine. Become an expert in your area of law. Establish yourself as a thought leader by writing articles, publishing books, and speaking at conferences. By positioning yourself as an authority in your field, you can attract more referrals from people who need your expertise.

Get involved in your community and volunteer

You’ll naturally meet people in your community who will recognize your commitment to the community. Focus on causes and events that align with your values and interests, and be genuine in your interactions with others. When you volunteer, you not only get the opportunity to give back to your community, but you also have the chance to showcase your skills and expertise to others who may require legal services. People will want to work with someone who is engaged in helping the community as a whole.

Be a guest on talk shows, podcasts, and other media

Meet with influential people to reach wider audiences and build credibility. When people see you as a trusted authority in your field, they will be more likely to refer you to others. Share your valuable insights and practical advice, and use examples to illustrate your points. Be sure to spread the love and promote the show on your social media channels to encourage your followers to listen or watch.To learn more about referral marketing, check out: 22 Proven Ways to Get Law Firm Referrals in 2022

Use video to showcase your community

Using video to showcase your community is a fun and effective way to connect with your audience. It's time to throw out the old social media playbook and embrace the potential of newer platforms like TikTok and Youtube. While Facebook still has its place, some really interesting things are happening on these other platforms.You can highlight what makes your community unique by creating short, engaging videos. Whether it's your favorite coffee shop, the best sandwich in town, or the local charity event you're sponsoring, use these platforms to showcase what matters to you and your clients. You can even interview local business owners to give your audience a behind-the-scenes look at your community.Social media marketing is a powerful tool for law firms to build their brand and generate leads. By creating valuable and entertaining content, you can establish yourself as a trusted expert in your field and connect with potential clients. Get creative and enjoy your social media content - your audience will appreciate it!Need some inspiration? Check out 9 Attorney TikTok Accounts You Need To Follow For Marketing InspirationDon’t miss out on these 9 Must-Watch Attorney YouTube Channels to Draw Inspiration From

Invest in paid advertising

Paid media is the best way to target ads to users actively searching for legal services or who fit specific demographics, interests, and behaviors. As with other marketing tactics, you can diversify how you spend your ad dollars. Let’s review the main ways your law firm can drive more traffic to your website, increase brand awareness, and, ultimately, generate more leads and revenue.

Search Engine Advertising (PPC)

PPC ads are displayed close to the top of search engine results pages (SERPs). Advertisers bid on specific keywords and pay for each click their ad receives, thus the moniker pay-per-click. Start with a small budget and test your ads to see which keywords and ad copy generate the most clicks and conversions. From there, adjust your budget accordingly. Track and measure Click-through rates (CTR), conversion rates, cost per click (CPC), and return on investment (ROI).

Social media advertising

Social media ads show up within users' feeds. These ads target specific audiences based on demographics, interests, and behaviors. Consider your target audience and which social media platforms they use the most. Start with a small budget and test your ads to see which generates the most engagement and conversions. Measure and track Impressions, engagement rates, click-through rates (CTR), conversion rates, and return on investment (ROI).

Retargeting

Retargeting ads are displayed to users who have previously visited or engaged with your website. Retargeting can be used across various platforms, including search engines, social media, and display networks. Start with a small budget and test your ads to see which generates the most engagement and conversions. Track and measure Impressions, click-through rates (CTR), conversion rates, and return on investment (ROI).

Talkin’ bout lead generation

Lead generation, or "buying leads," is a marketing strategy that involves purchasing contact information (such as email addresses, phone numbers, and names) of individuals who have expressed interest in legal services related to personal injury cases.While lead generation can be effective for personal injury law firms to acquire new leads, it's important to note that not all of these leads are created equal. Some of the names may need to be qualified leads, meaning they may not have a genuine need for legal services. As a result, be cautious when buying leads and have your intake team thoroughly vet leads to ensure they are good cases to take on.One of the most effective paid lead generation channels is Google Local Service Ads (LSAs). These ads have been designed to operate on a pay-per-lead (PPL) model. LSAs are only available to law firms that first pass Google's screening process, which requires them to have a valid license to practice law in their state, a background check through a third-party agency (Pinkerton), and can confirm insurance coverage. LSAs appear at the top of the search engine results pages, pushing PPC, the local map, and organic searches farther down the page.For law firms, you may want to also look into well-known brands like Lawyers.com, FindLaw, Nolo, and Martindale-Avvo. The services these companies provide can vary, with some relying on SEO-driven traffic to their directory pages and others using pay-per-lead models. While these services are popular, they have drawbacks. Many leads are driven by a name search for a specific personal injury lawyer and then resold back to another personal injury law firm. So, make sure to ask a lot of questions when choosing lead generation services, as the economics of these companies can be poor.

Convert more leads with Lawmatics

Marketing is an essential aspect of running a successful personal injury law firm. The industry is highly competitive, and you need to execute a comprehensive marketing strategy that aligns with your business goals and tracks your performance. However, to truly maximize the potential of your marketing efforts, you need a CRM like Lawmatics.Lawmatics is specifically designed for law firms and can help you track your marketing ROI and lead-to-client conversion rate. By tracking these metrics, you can determine your marketing tactics' effectiveness and identify improvement areas.By segmenting and targeting your audience, you can deliver personalized content that resonates with potential clients and nurture your leads. The best part is you can automate communication, so balls are never dropped, and you can keep your lead-to-client conversion rate high.Don’t leave marketing money on the table. Get a demo today.

Subscribe to get our best content in your inbox

Ready to grow your law firm with Lawmatics?

Schedule a demo of legal’s most trusted growth platform.

.avif)

.avif)

.avif)